This spring, students from the School of Business prepared tax returns for fellow Conestoga students at clinics held at the college’s Brantford and Kitchener - Doon campuses.

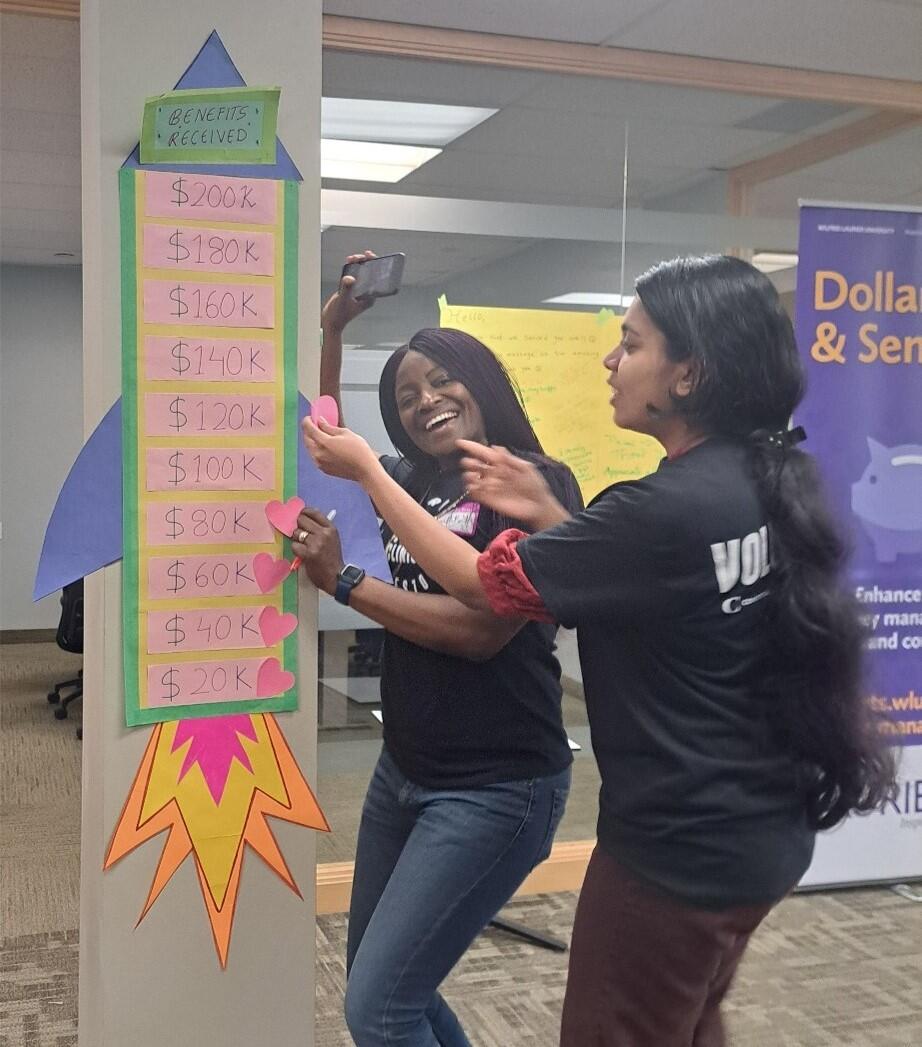

Volunteers track government benefits accessed by students who attended tax clinics at the college's Brantford campus.

The six clinics (four at Brantford and two at Kitchener - Doon) served over 300 students and processed more than $500,000 worth of returns, credits and benefits. Over 75 students volunteered across both locations, with some handling the tax filing duties while others focused on welcoming and triaging clients and preparing paperwork.

“Participation has been increasing steadily at these clinics, which we’ve been offering for several years,” noted Karey Rowe, chair, School of Business.

“They’re a very important initiative for us. They serve as a practical learning opportunity for those preparing tax returns, and they educate students on an essential service, helping them to unlock access to government benefits such as the climate incentive and ensuring they’re compliant with tax filing.”

Karen Adams, a chair in the School of Business who played a pivotal role in planning and executing the clinics at the Brantford campus, commented on the impact the clinics have beyond the classroom.

“This is the second time Conestoga Brantford has brought this amazing opportunity to students in the community. The skills learned will enhance their career opportunities as they have the potential to impact their peers, family and community members going forward.”

Rowe and Adams also highlighted the importance of awareness in understanding the rules and regulations of the Canadian tax system as they’ve found many students that visit the clinics are unfamiliar.

Students performing tax returns received academic credit and a grade for their work in lieu of an assignment. To ensure accuracy of returns and reinforce the learning aspect, School of Business faculty volunteered their time to double-check all work that was processed.

“Participating in the clinic was a truly wonderful experience,” said Harmeet Singh Ahuja, a Management and Leadership Development student at the college’s Brantford campus.

“It not only allowed me to help our community members navigate through their tax filings but also enabled me to enhance my skills in tax preparation, client interaction, and problem-solving. The hands-on experience has been invaluable, and the knowledge I gained has significantly contributed to my personal and professional growth.”

The clinics were open to all Conestoga students and were free of charge, helping students with what Rowe notes is becoming an increasingly expensive service. This was especially helpful for students who were also having taxes done for their spouses, which accounted for over 10 per cent of those served.

“The student volunteer was really helpful and friendly. She explained the process as she was completing the taxes and was really detail oriented, making sure the information she had input was correct,” said Mariana Guevara Hernandez of her experience at the clinic.

Other students who were being served also had positive sentiments to share.

“The management team and senior tax experts (professors) available were very knowledgeable and helpful,” said student Mayank Mayank.

“The volunteerism is really inspiring to see as it takes a lot of time and work to execute these clinics,” added Mona Nouroozifar, dean of undergraduate studies, School of Business.

“The benefits experienced by faculty and students extend beyond the classroom and contribute to a supportive atmosphere of community and learning at the School of Business and throughout Conestoga.”

Conestoga’s School of Business provides numerous opportunities and pathways to complete, specialize or expand business education through full- or part-time studies. Its programs reflect today’s business needs across a wide range of credentials from apprenticeships, one-year certificates, two- and three-year advanced diplomas, to graduate certificates and degree opportunities that include multiple specializations.